In the dynamic realm of futures trading, success often hinges on the ability to spot lucrative opportunities amidst market fluctuations. One powerful strategy that seasoned traders employ is recognizing and capitalizing on leverage moments. By understanding how leverage works and strategically calculating its effects, traders can unlock potential profits and navigate the futures market with confidence.

Deciphering Leverage Moments

Leverage, in essence, amplifies the impact of price movements, allowing traders to control larger positions with a smaller amount of capital. While this presents an enticing prospect for maximizing gains, it also heightens risk. Hence, identifying opportune moments to leverage becomes paramount.

Calculating Leverage

The first step in leveraging moments effectively is comprehending the concept of leverage ratios. These ratios represent the proportion of borrowed funds to trader's equity. By calculating leverage ratios, traders can gauge the extent of their market exposure and assess risk levels accurately.

Recognizing Trading Opportunities

Market Volatility

Leverage moments often arise during periods of heightened market volatility. Sharp price fluctuations can magnify gains or losses, presenting fertile ground for astute traders to capitalize on short-term price movements.

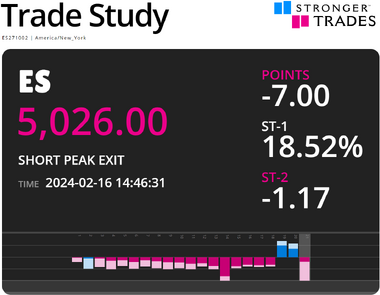

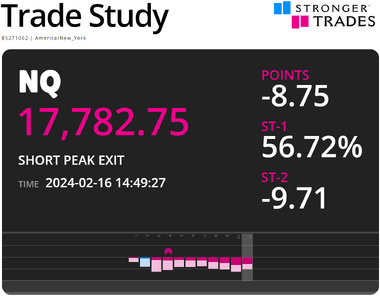

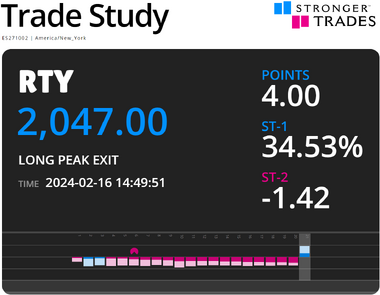

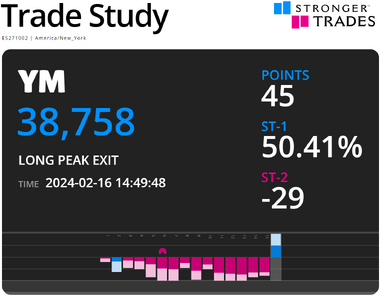

Technical Indicators

Technical analysis serves as a valuable tool for identifying potential leverage moments. By scrutinizing price charts and employing technical indicators such as Stronger Trades ST-1, and ST-2, traders can pinpoint entry and exit points with greater precision, optimizing leverage usage.

Fundamental Analysis

Supplementing technical analysis with fundamental insights can further enhance trading decisions. Monitoring economic indicators, geopolitical events, and market sentiment provides valuable context, enabling traders to anticipate price movements and leverage opportunities arising from market shifts.

Mitigating Risks

While leverage can magnify profits, it also amplifies risks. Prudent risk management is essential to safeguarding capital and mitigating potential losses. Implementing stop-loss orders, diversifying portfolios, and adhering to disciplined trading strategies are vital practices for managing risk exposure effectively.

In the fast-paced arena of futures trading, recognizing and capitalizing on leverage moments can spell the difference between success and failure. By mastering the art of calculating leverage, identifying trading opportunities, and implementing robust risk management strategies, traders can navigate the complexities of the futures market with confidence and precision, positioning themselves for long-term profitability and success.

Posted: 2024-02-22 16:29:38

Alerts & Notifications, Leverage, Market Fluctuations, Risk management, Tips

- The Journal: Trader Blog

- Category - Alerts & Notifications

- Category - Chart Analysis

- Category - Diversification

- Category - Education

- Category - Fed Day

- Category - Futures trading

- Category - High returns

- Category - Leverage

- Category - Livestream

- Category - Market Fluctuations

- Category - Market volatility

- Category - Opinion

- Category - Performance

- Category - Recession

- Category - Reflexes

- Category - Risk management

- Category - Speculation

- Category - Success rate

- Category - Tips

- Category - Trade of the Week

- Category - Trading Class

- Category - Treasury Bonds

- About Stronger Trades

- Learn to Trade

- Membership Benefits

- The Trade Study